Compass Group PLC (CPG LN): A high-quality compounder at a reasonable price, offering a 17% IRR.

Most high-quality businesses with strong ROICs trade today at crazy valuations. Compass seems to be an exception.

Introduction:

Outsourced food services (i.e. catering) looks like a boring and un-sexy business.

Pre-COVID, organic revenue growth has been meagre at ~MSD. Operating margins are low at ~5-7% due to labour and input cost intensity and industry competition for food service contracts. There are challenges with staff training and retention, as well as logistical difficulties operating across different sectors, types of food, price points, venues, and geographies. You'd also be tempted to think that food service is commoditized given the wide range of dining options available to people.

So why would you want to spend time looking at a stock like Compass Group (CPG LN), a food services business, that currently trades on a NTM PE multiple of 25x?

Here are some reasons.

First, this is actually a high-quality business:

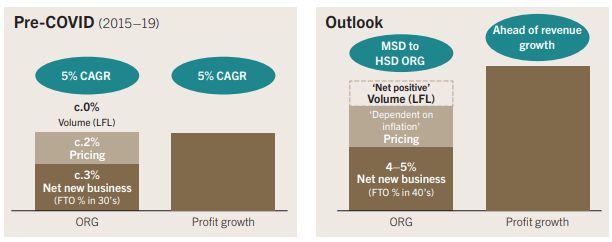

Decent organic growth (revenue of +MSD-HSD) with ongoing operating margin progression of ~15-20bps/yr, has potential to grow EPS by +DD.

Stable and resilient demand providing sound earnings visibility:

Demand for food is stable (i.e. people need to eat).

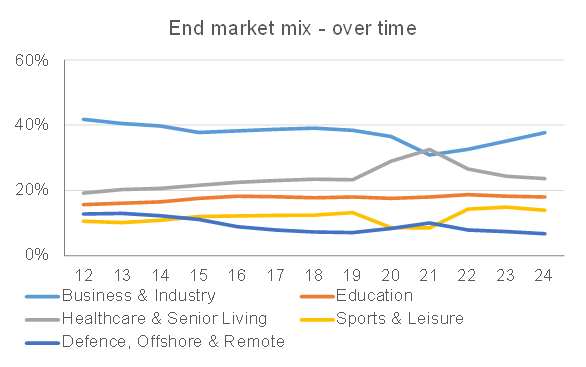

Revenue is well balanced between sub-sectors, brands, price points, and geographies.

45% of revenue is from defensive sectors like healthcare and education.

Healthy balance sheet (current leverage 1.0x EBITDA, ~$2bn of BS firepower vs. Compass' 1.5x leverage target by FY25 year-end).

~85% FCF conversion (from Adj. net income) to fuel organic reinvestment, buybacks, or M&A.

ROIC is strong at ~18-20%, with ample opportunities to organically reinvest at a similar return profile.

The operating model is highly decentralised with geographic segments (North America, Europe, and Rest of World) managed and incentivised independently, each with their own portfolio of food service brands.

Great culture with a focus on internal training and advancement. The current US Chief People Officer supposedly joined the business many years ago as a waitress and never left.

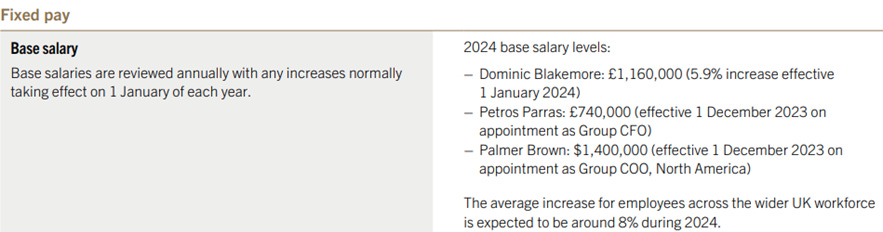

Sensible and shareholder-friendly management incentives:

Annual bonus (max 100% of base salary): 85% financial measures (operating margin, cash conversion, and organic growth), remaining 15% on ESG and safety.

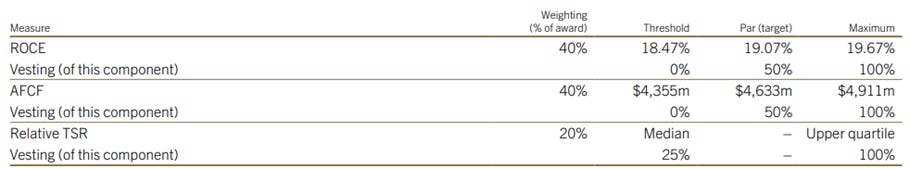

LTIP (max 100% of base salary): weighted 40/40/20 between ROCE, average 3yr underlying cc. FCF generation, and comparative TSR (to FTSE 100 members).

Second, Compass has a strong competitive position as the largest and best food services provider, with a durable advantage from procurement related economies of scale:

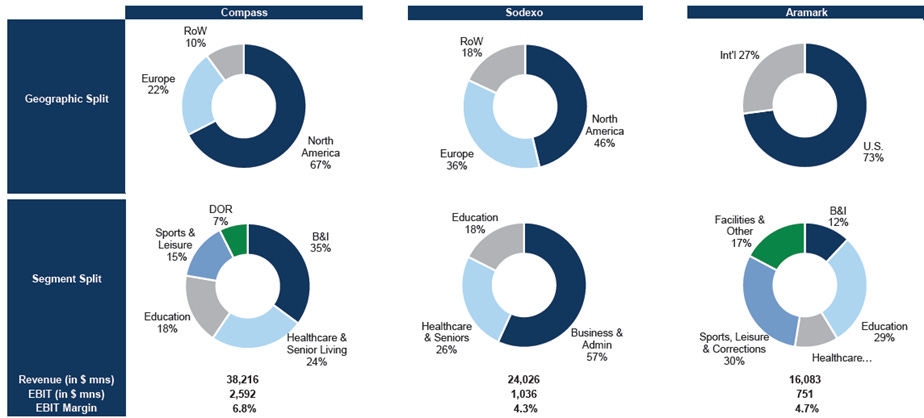

Compass is the largest (by >2x) of the 3 publicly traded food services businesses. The others are Aramark and Sodexo.

Being large brings economies of scale through operating leverage and food procurement cost savings. More on this later.

Compass has the largest and most diverse portfolio of food service brands, and the best organic growth, operating margins, balance sheet health, and ROIC of its peers.

Third, Compass is experiencing structurally higher growth post-COVID (of +HSD revenue):

The annual decline in the proportion of the global catering market served by self-operators has accelerated from 25bps/yr pre-COVID to 60-70bps. Compass, Aramark, and Sodexo are all talking about a very favourable environment for first-time outsourcing, winning new business, and retaining clients.

This is because large, outsourced caterers are better able (vs. self-operators or smaller regional operators) to:

Be more competitive on price (due to operating leverage and scale procurement benefits);

Have more adequate staff training and resourcing;

Offer better food experience and quality (given they can better afford to buy high quality ingredients);

Comply with onerous food health and safety regulations;

Provide digital offerings (e.g. pre-order and pre-payment methods, loyalty discounts);

Meet sustainability and ESG requirements; and

Cater to a variety of dietary, nutritional, taste, and menu requirements.

There is also an ongoing margin improvement story.

Compass has beat and raised numerous times in 2024. In Q1 of 2024, the CEO commented that Compass "is in as good shape as it has ever been in my tenure".

This year the stock has re-rated higher, with the market starting to price in higher growth. However, looking at consensus estimates today, the market is still not pricing that 1) +HSD growth can be sustained in FY25 and beyond, and that 2) margin improvement will continue beyond the next 1-2 years. My estimate of next 3yr Adj. EPS growth is 14.0%, compared to consensus of 10.3%. This forecast does not rely on aggressive assumptions.

Speaking to the Compass management team, they believe that they have the ingredients to sustain higher growth for numerous years to come.

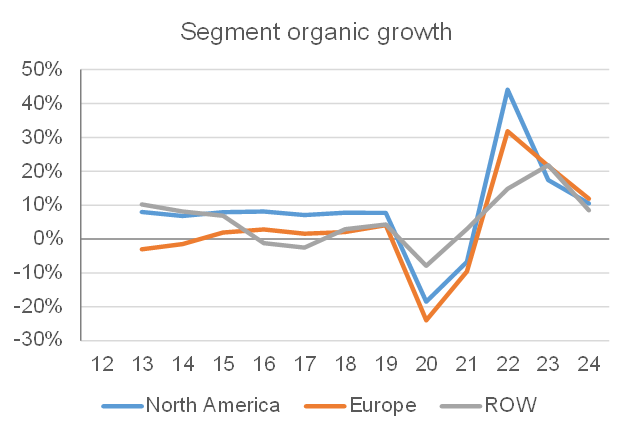

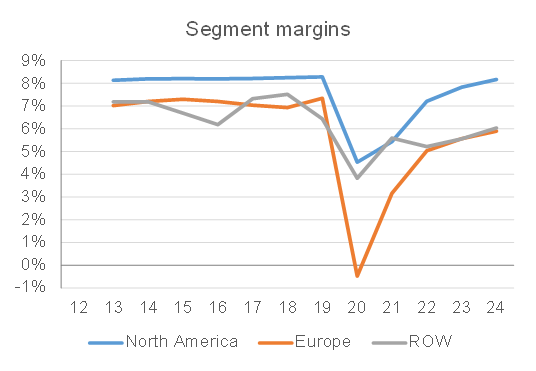

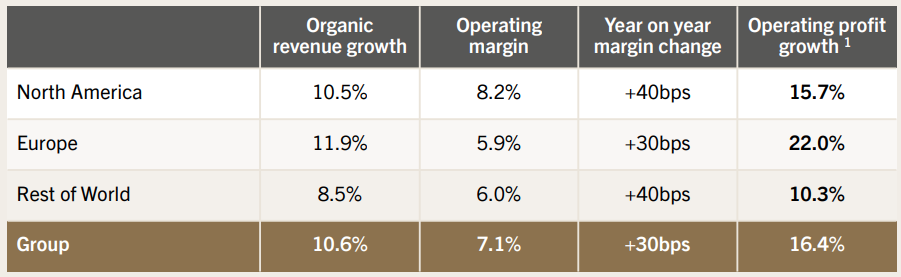

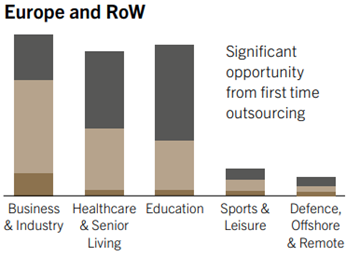

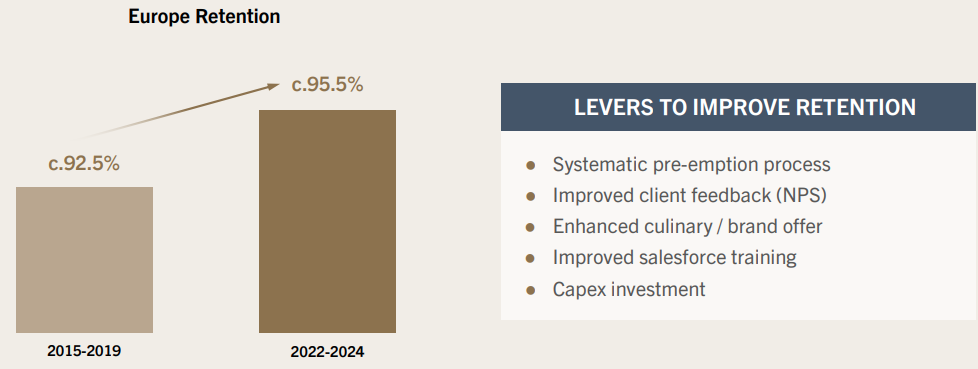

On top of that, the European business, which has historically been lower growth and lower margins compared to North America, has been completely turned around after COVID with a new management team, new incentives (that prioritise growth), and fragmented sales and retention processes being replaced by proven playbooks that previously worked in the US. As a result, we are seeing growth, margins, and customer retention rates improving. Organic revenue in Europe grew faster than in North America in FY23 and FY24, whereas historically it was always substantially lower.

I will go through each of the above points in this post and will share my thoughts on valuation. Based on my numbers, buying the stock today at a share price of US$34.3/sh and multiple of 25.0x is implying a 3yr IRR of 17.0%.

This is a detailed article and is informed by months of notes from following Compass, Aramark, and Sodexo, and several investor calls with the Compass management team. I have not yet seen a recent write-up of similar depth online (if you are aware of any, please send them to me).

In summary, I view Compass as a high-quality business that, unlike most of the large cap quality universe, is not trading on a very expensive valuation, and has the right drivers and competitive advantages to continue to compound at an attractive rate for many years to come.

Business Overview and History:

Compass Group (CPG LN, FY24 revenue of $42.0bn, market cap of $57.1bn) is a global leader in food services (86% of revenue) with some related support services (14% of revenue). Support services are typically more specialised than a standard provider of cleaning or facility maintenance services (an example: ultraviolet light cleaning of blood spots in an operating theatre).

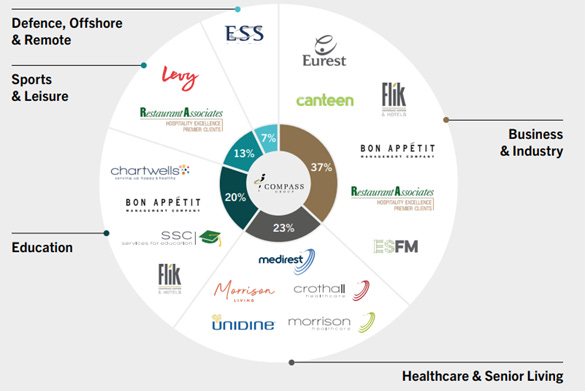

The mix of clients is very diverse and includes corporate offices, factories, schools, universities, hospitals, major sports and cultural venues, mining camps, correctional facilities, and offshore oil platforms. Compass delivers food services through a diverse portfolio of brands. They employ >500k people globally.

Compass originated from the merger in the early 1980s of two industrial catering businesses that were started in the early 1940s (Factory Canteens and Midland Counties). Both were involved in serving food and drink to manufacturing or repair munitions workers in the UK during the Second World War. After a management buyout in July 1987 (largest in the UK at the time) and subsequent re-listing on the LSE in 1988, Compass pursued growth through a strategy of 'sectorisation' (i.e. expanding in adjacent sectors and categories) fuelled by acquisitions of food service brands, initially in the UK and then internationally from 1993 onwards.

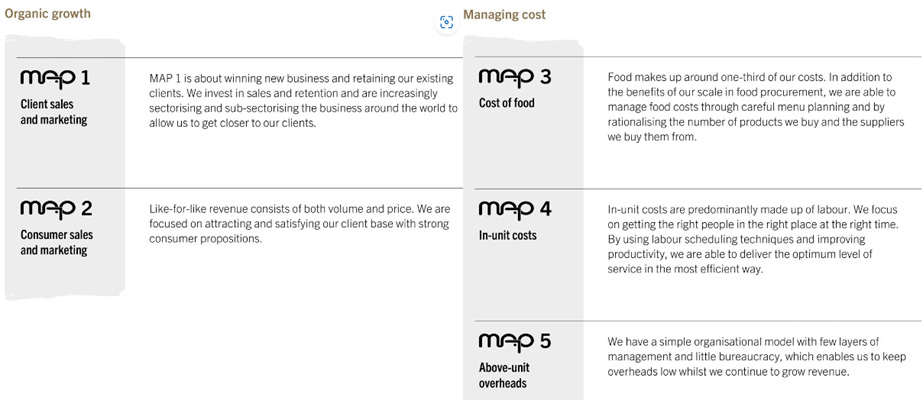

This strategy continued unabated until the previous (and belated) CEO Richard Cousins arrived in June 2006. At this point, Compass was much larger and much more complicated. Cousins established the MAP operating framework and committed to simplifying the business by improving governance, reducing operating and disclosure complexity, and decreasing the number of operating countries from 96 to 50 (note: Compass is now at 30 countries).

Dominic Blakemore (the current CEO) became CEO when Cousins died in a tragic plane accident in Australia in December 2017, 3 months before he was scheduled to retire. Blakemore led with a mandate to continue to grow the business through sectorisation but with a deeper focus on its core countries.

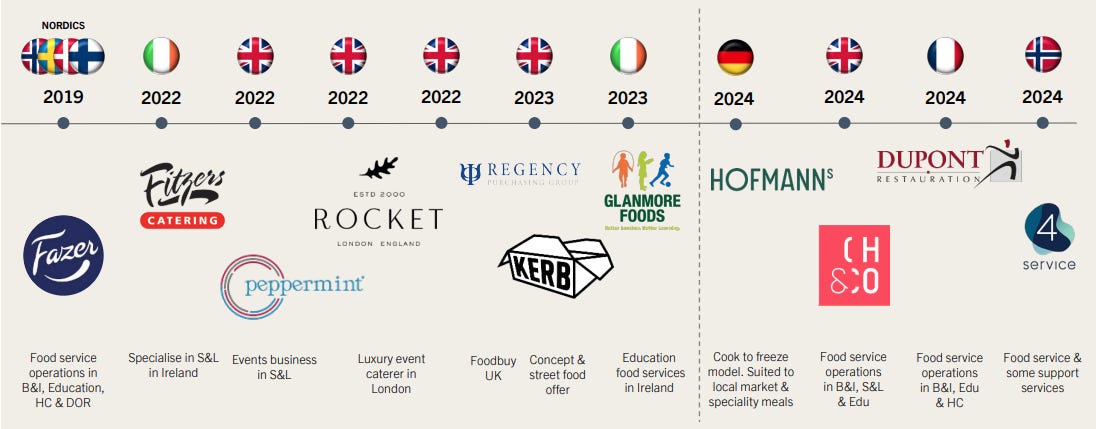

Below shows a timeline of acquisitions that Compass has done:

Business Mix and Segments:

The business uses 3 types of contracts - incl. cost plus, fixed price, and P&L, with about 1/3rd exposure to each. Around 50% of the cost base is employee costs and ~30% is food.

Compass operates across 5 sectors, 3 regions, and 30 countries:

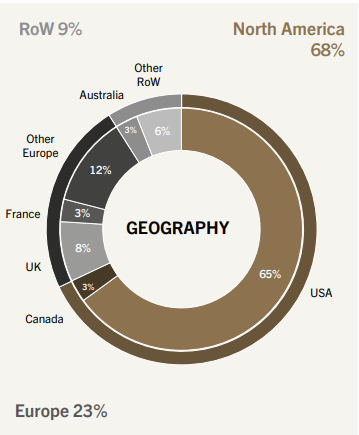

North America (67% of revenue, 7.8% margin)

Europe (22% of revenue, 5.6% margin)

ROW (10% of revenue, 5.6% margin)

Here is the detailed country revenue mix:

Below shows the sector mix and numerous brands that Compass operates (a total of 24 brands):

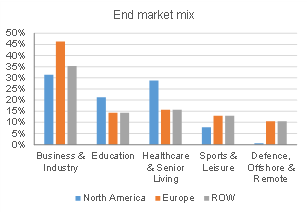

Here is the end market mix by region:

The operating model of the business is very decentralised. The North American, European, and Rest of World businesses are managed independently, and within those segments there are numerous independent business units. These disparate units are supported by a MAP (i.e. Compass' operational excellence) framework to drive performance across the business, allowing it to both meet local needs (with a variety of brands for different type, quality, and price of food service) and establish global food partnerships with large organisations.

As seen below, historically North America has had the highest growth and margins of the three geographic segments. Compared to Europe, North America has a higher ROCE of 26.4% (vs. 15.8%) and higher client retention of 96.4% (vs. 95.5%). Market share is about 20% in North America vs. 7% for Europe.

US customers are typically comfortable with longer contract durations of ~5 years. There is less competitive pressure and hence less churn. Contracts often roll without a competitive process, while in Europe a contract expiry is typically a trigger for a competitive RFP. Average contract duration in Europe is closer to 3 years.

In the past the management team of the European business were being incentivised too heavily on margins. As a result, growth was slow, and the business never really grew to a sufficient scale. Scale is very important in the food services business.

Coming out of COVID, the European business was 50% B&I (Business and Industry). Compass saw a massive opportunity in sports, healthcare, and education (similar to North America), and they went after it. Palmer Brown (current COO of North America, previous Group CFO) played a key role in turning around Europe, which started shortly after COVID hit. The COVID shutdown provided an ideal environment to disrupt and change the business. North American staff came in, shattered the stale culture, and implemented significant operational changes such as staff re-training, a new CRM system, the existing European CEO was fired, and a new leadership team was put in place with a compensation structure that incentivised growth.

Encouragingly, since FY23 we are seeing organic revenue and operating profit growth in Europe be higher than North America for the first time. Here is the result for FY24:

Market:

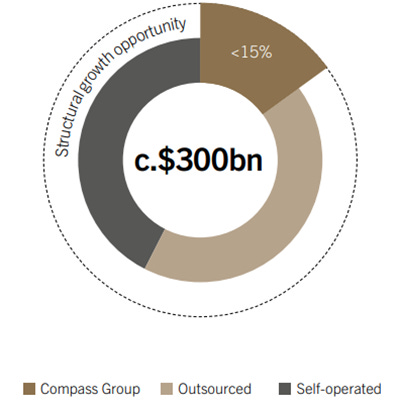

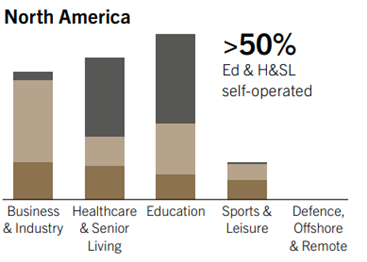

Compass Group is estimated to have <15% market share of the global ~$300bn Food Services market. Over ¾ of the market is still self-operated or in the hands of small, regional players, so there is a huge runway for growth and market share gains. 90% of the market share opportunity for Compass is in North America and their next top 10 countries.

Over time, Compass has been gaining share. Larger outsourced providers like Compass experience economic benefits of scale (mainly in procurement), are typically 15-20% cheaper than in-house solutions, and are better equipped to deal with operational complexity and additional service offerings. They also allow customers to focus on their core competency, rather than preparing and serving food.

Management commented that clients are now asking them to provide much more than just food. They also want Compass to:

Consider food waste and sustainability, nutritional and dietary requirements;

Comply with more stringent safety and food health regulations;

Manage staffing issues;

Provide improved food quality, variety, and provenance (i.e. where it comes from);

Provide a digital app (for ordering ahead and digital payments), and allow for dynamically priced special offers and loyalty programs; and

Organise community events/programs that relate to food.

Inflation also helps to drive new business growth. Rising food and labour costs make it even more expensive to do food services in-house, which widens the cost advantage of a large, outsourced provider like Compass.

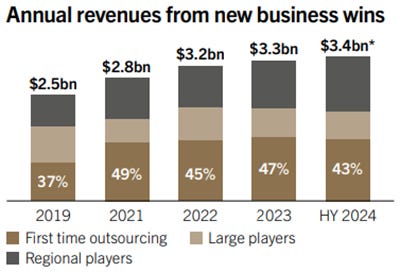

As a result, the annual decline in the proportion of the market served by self-operators has accelerated from 25bps pre-COVID to 60-70bps today, and expectations are that these trends could persist for a decade. Around 40-45% of the gross new business that Compass is winning today is in the form of first-time outsourcing.

Compass commented that they are having more C-suite meetings about food services with large corporates than ever before.

Competitive advantage:

At this point you might ask, how is Compass able to sustainably compete with regional food services providers? Won't they struggle to win vs. local players with a core competency in their local area?

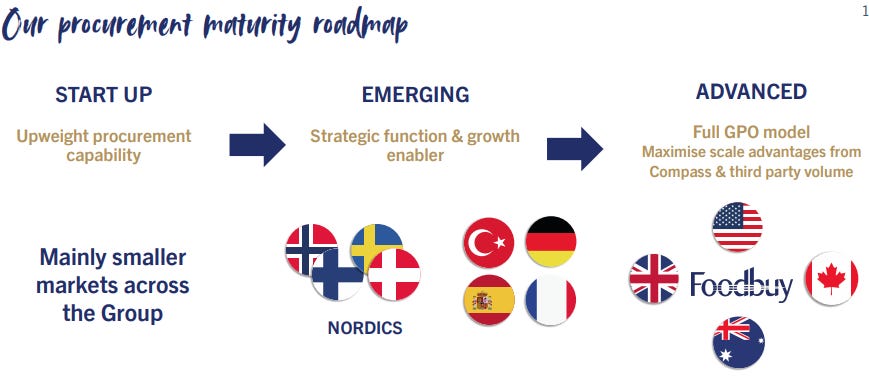

The main competitive advantage Compass has against these smaller regional players is a material cost advantage when procuring food at scale. Compass spoke about this in an investor day going over their procurement business in mid-September of 2024.

Within Compass Group is a business called Foodbuy, which was acquired back in 2000 and since then has grown to be the largest and most advanced group purchasing organisation (GPO) in the world. They have a huge amount of data related to food procurement. They also assist with supply chain management and distribution of food service products and ingredients.

Foodbuy is based in the US and employs >1k people. They have >160k client locations, deal with >3k suppliers, and source >750k SKUs. In total they procure ~$32bn of food and beverage products, with 40% of that being for internal Compass Group business units (collectively Compass is the largest customer), and the rest is for 3rd parties.

The procurement cost saving that Foodbuy achieves is typically in the double digits. It also helps Compass win new business (given that they can help customers source the best quality ingredients at the best prices).

Most food staples products (such as eggs, flour, butter, bacon, etc.) across the business units are sourced from the same large preferred supplier which is procured on the basis of quality, reliability, and offering the most competitive prices. Any ingredient that is procured is typically leveraged across at least 5 different recipes, otherwise it is considered to be too niche and not worth procuring.

3rd party customers that use Foodbuy services are charged a fee, and receive discounts for the greater compliance they show in using Foodbuy's list of preferred suppliers. This provides a flywheel that helps both members and preferred suppliers grow. Importantly, adding compliant member spend also reduces Compass' procurement costs given the benefits of scale, and most of the income that Foodbuy generates is reinvested in additional technology and resources to further improve supply chain management for 3rd parties. The compliance rate in the US has been excellent at ~95%.

There are now established Foodbuy GPOs in Canada (launched in 2006), the UK (launched in 2016), and Australia (launched in 2018). These markets, together with the US, account for nearly 80% of Compass' revenue.

Foodbuy UK was established in 2016 following the acquisition of Acquire Services, a specialist food procurement business, which was later merged with Compass' internal purchasing function. The current procurement spend is >$2bn, compared to ~$750m in 2016. The goal is to get to >$3bn, fuelled mainly by growth in 3rd party business. As an example, the recent acquisition of CH&CO will boost scale and grow food buying by ~$180m.

There is also an effort to establish a Foodbuy EMEA business. The challenge is that this GPO operates in 18 countries that are very different (e.g. by language, culture, systems, data, regulations, and supply chain structures), so most of the purchasing is managed within single countries. While it may not be possible to replicate the success of the US model on a pan-European basis, it's clear that the EMEA GPO can operate at a significantly larger scale one day, structured as numerous individual country GPOs with some degree of overlap.

Clearly there is a competitive advantage here that grows as Compass gets bigger.

As Compass grows, they will procure food products at better prices, and pass on these savings internally and to 3rd parties. This will help them grow their 3rd party procurement business, which helps their suppliers grow, and the cycle continues. In the meantime, with higher margins and cash flow conversion, Compass can reinvest organically in new food service contracts, increasing the scale of their business, which completes the flywheel.

This virtuous cycle is a very attractive component of Compass' business model and should support a strong and rising ROIC over time, and should help them win share from their competitors.

There is another scale-related competitive advantage that Compass enjoys over smaller regional or local providers. Given the demand from customers for a higher value service (e.g. food sustainability, variety, dietary and nutritional requirements, etc.), Compass is able to invest more in central corporate resources (e.g. they are the largest global employer of food nutritionists) to drive a competitive service advantage to win more business with clients.

As an example, Compass is able to use sports and leisure stadium ticket sale data, which includes the age and demographics of those attending, to more accurately calculate what type and quantity of food and beverages to serve in the stadium, and how to efficiently serve it. This sets their quality of service apart from less sophisticated offerings.

Organic growth:

Compass has guided to +HSD organic revenue growth, supported by +4-5% net new business (i.e. new business won less churn), which is higher than what the business has achieved historically (~3%), combined with pricing of +2-3% and some volume.

Volume is hard to drive in the long term (i.e. people don't eat two lunches). Growth is coming from 1) Compass having better relative value vs. the high street (i.e. they are cheaper than many local restaurants and shops, leading customers to buy more often and buy more ancillary items), and 2) they are becoming more efficient at serving (through digital tools, e.g. ordering ahead, analytics for menu assortments at sporting events, etc.).

In their recent FY24 result, management commented that business in North America remains as attractive as ever with a large runway for growth across all sectors. Performance in Europe is improving, and the sales pipeline has expanded significantly. Europe retention has increased to 95.5%, a substantial step-up vs. pre-COVID of 92.5%, thanks to a number of retention initiatives.

Peers Aramark and Sodexo have also commented on the strong outsourcing environment and pipeline for new business (see in section on competitors below).

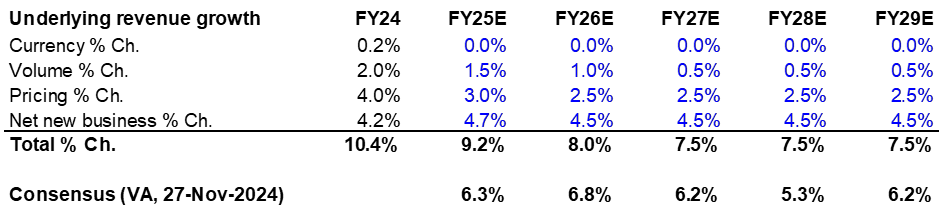

Here are the consensus estimates from Visible Alpha for underlying revenue growth vs. my numbers in blue:

The market essentially doesn't believe that 1) volume growth will be positive from FY25 onwards and 2) that net new business can be sustained at a level above 4%.

Given that Compass has high cash flow conversion and the ability to reinvest at a high ROIC, this extra ~1-2% of organic revenue growth can have a meaningful impact on earnings growth and valuation.

Margins:

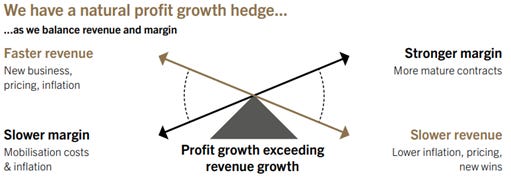

Group operating margins peaked at 7.5% in 2019, after which point COVID significantly disrupted the business. FY24 margins came it at 7.1%. Management has regularly commented that they expect continued margin progression, and are confident of surpassing their previous margin level of 7.5% (likely sometime in the next 2-3 years). Margin improvement will come from increasing economies of scale from procurement cost savings (more on that in a section below), productivity improvements, and operating leverage.

Importantly, higher growth for Compass typically results in lower operating margins in the short term. Newly established food service contracts typically take some time (depends on the contract, anywhere from 6-24 months) to become fully profitable due to upfront mobilisation costs.

As such, it's likely that the true margin potential of Compass today is hidden, for several reasons. Organic growth is running 2-3% higher than pre-COVID, and margins will be pushed higher as these food service contracts start earning at full potential. The business has also been growing inorganically (e.g. net acquisition spend for FY24 was $1bn), bringing opportunities for efficiency gains in these acquired businesses from centralising corporate functions and achieving more procurement cost savings.

There's also the ongoing turnaround of the European business, with margins recovering back to 6% for the first time since COVID. Margins in Europe were higher at 7.3% in 2019 but the business was smaller and organic growth was negative, compared to 15% organic growth in Europe in FY24.

New food service contracts also sometimes bring some upfront capex in the form of contract fulfilment assets (i.e. fitting out a commercial kitchen to serve food) and contract prepayments, which means that free cash flow margins are also suppressed in the short term.

Consensus estimates (Visible Alpha) for underlying operating income margins are for Compass to get above 7.5% in FY26-27, and for margins to stay basically flat from FY27 onwards. Given everything that is going on in the business, I wouldn't be surprised if Compass exceeds these expectations.

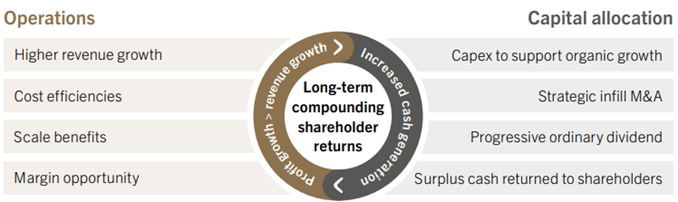

Capital allocation:

Compass has strong free cash flow generation of ~85% or more.

First, they pay a healthy dividend with a payout ratio of ~50%.

Thereafter, management commented that they have a strong preference for organic reinvestment within the business. The most attractive opportunities are large food service contracts that involve millions of upfront capex. The term of these contracts are long (e.g. sometimes as long as 20 years) and the ROICs are ~20%. As an example, they are seeing ample opportunity to go after catering contracts for large sports stadiums across Europe.

The upfront capex is typically split 25% for food service infrastructure that Compass operates (e.g. kitchens and equipment), and the rest is infrastructure at the client venue (e.g. dining halls, furnishings, serving areas, etc.).

In FY24, Compass has also been active in M&A, with net spend of $1bn related to acquisitions of CH&CO in the UK, HOFMANNS in Germany, Dupont Restauration in France and 4Service in Norway. These larger European acquisitions are intended to build out geographic and sector coverage and get the European business to scale. Previously Compass was ‘stretching’ their brands too far (e.g. using a high-end food service brand for blue collar workers), and they now want to have unique brands in all areas of the market.

There are substantial synergistic benefits to these acquisitions. Compass will typically protect all the front-end brand assets but rip out and replace the back-end systems (i.e. HR, finance, payroll), and achieve double digit cost savings from procuring through Foodbuy. This has been the playbook in North America for years.

Being #1 in the market has huge advantages, given the economies of scale involved in this business model. While Compass is not yet #1 in all of their European markets, they have the balance sheet health and momentum to go after the opportunity, and management is clearly focused on this in the near term.

Going forwards, M&A will focus on bolt-ons of procurement organisations, micro food service markets (such as vending) in North America, and individual subsector brands in Europe to continue to build in-country scale.

Buybacks are likely to get larger from 2H25 onwards. Current leverage is at 1.0x EBITDA compared to their target of 1.0-1.5x, so there is plenty of headroom for additional M&A or buybacks.

Market and competitors:

Compass' main competitors are Aramark and Sodexo.

While the industry is competitive, client turnover is low with retention typically >90%. Compass has the highest margins, customer retention, organic growth, and balance sheet health.

There are some differences to note between Compass and their peers in terms of end market exposure and competitiveness in certain markets (e.g. Sodexo is more dominant in certain European countries such as France). Overall though, Compass has much greater coverage across different geographies, sectors, and value propositions.

Looking at peer results and commentary, all are experiencing similar trends of a very strong outsourcing environment and pipeline for new business.

Note that FY24 net new business for both Sodexo and Aramark was much lower (at 1.6% and 2.2%), due to various operational challenges and contract losses, than Compass of 4.2%.

Sodexo reported in late October:

+7.9% organic growth (or +7.5% excl. Olympics and the rugby world cup), was 10bps above consensus, driven by food services at +9.3% (now 66% of total revenue).

Guidance for FY25 is organic revenue of +5.5-6.5% (vs. prior commentary of towards bottom of 6-8% range). Breaks down into pricing of +3%, volume of +1-2%, and net new of 2-3%. Think volume can be maintained long-term (mostly upselling and more attendance in corporate services). Margins guide of +30-40bps.

Retention of 94.2% was disappointing after 95.2% in prior year, affected by loss of a global FM contract for 60bps. Two contracts lost in Latin America due to one-time challenges in energy and resource were a further 30bps. Of remaining 490bps of losses, 40bps were due to site closures and the rest was from competitors (and some moving in-house, e.g. healthcare customer in Canada).

Had record new wins at 7.4% (1.6bn EUR), above pre-COVID average of 6.5% and FY23 of 7%.

Net new was 1.6% (declined from 2.2% in FY23). Hoping to restore net new business rate of >3% in the medium term.

Pipeline today is higher than it has ever been (+25% on FY23), more targeted and more advanced than usual, so should support a strong 1H25. FTO trends in North America remain strong at 43% of total new business.

Aramark reported their Q4 result in mid-November:

Revenue grew organically by +7% with operating income of +8%. They guided to FY25 organic revenue growth of +7.5-9.5%, Adj. operating income of +15-18%, and Adj. EPS growth of +23-28%.

Record gross wins (9% of revenue) but retention lower at 93.2%, suffered from two lower margin facility contract losses. Net new for FY24 was only 2.2%, much below 4-5% target level.

Leverage is now at 3.4x, expected to be at 3.0x by FY25.

Commented that the environment is very robust, opportunity for gross new business is great, and the pipeline is strong across all business units. Seeing no change to the cost or economic profile of winning new business.

Focused on growth of GPO (procurement), had commented to pass $20bn in spend by FY24. A core driver of profitability going forward. Will look to grow with acquisition opportunities.

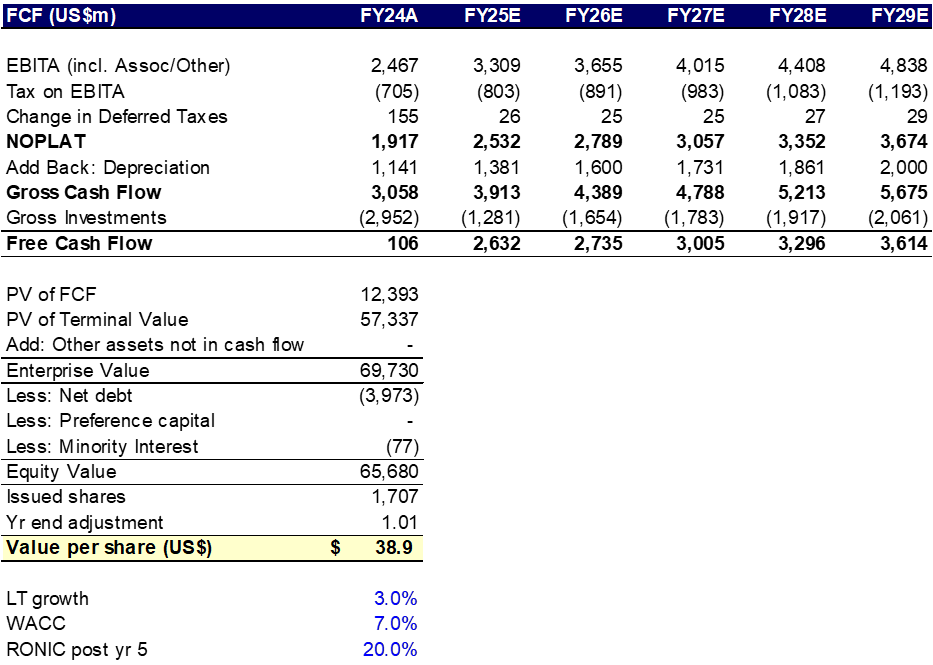

Valuation:

Here is some assumptions I make in forecasting the earnings and cash flows of the business:

+HSD organic revenue growth (i.e. 4-5% net new business is sustained with >0% volume)

Operating margin expansion of 15-20bps per year

Capex sustained at 3.5% of revenue (as per guidance)

Effective tax rate of 25.5% (as per guidance)

I don't model any inorganic growth but instead allocate a meaningful proportion of FCF towards buybacks (starting at $1bn in FY25 and growing $200m in each year). With forecasted FCF of $2.4bn in FY25, this leaves the potential for upside to these numbers from 1) larger buybacks or 2) accretive M&A.

I forecasts next 3yr Adj. EPS growth of 14.0%, compared to current consensus of 10.3%, which I view as too low.

Compass is currently trading on 25.1x my FY25 Adj. EPS number of $1.36. This equates to a 4.1% FY25 FCF yield.

Buying it today at US$34.3/sh, assuming it sustains a multiple of 25.0x, gives a 17.0% IRR, which closely approximates the earnings growth and a 2.0% dividend yield. I assume no potential further multiple expansion. This is a pretty decent risk-return given the stability of the business.

A DCF valuation (assumptions shown below) provides an intrinsic valuation of ~$39/sh.

While not necessarily cheap, I'm comfortable with the valuation given the business quality. A 17% compounded return is also pretty good.

Risks:

The main things I will be watching are:

Any risks to Compass sustaining net new business growth of 4-5%, as well as volume growth of >0%;

Progress on operating margin expansion; and

Capital allocation - i.e. specifically what businesses are bought, and how they fit into the existing portfolio.

There is a risk that the macro environment deteriorates, leading some customers in more cyclical sectors to cut back on food services related expenses. Management has commented that the industrial part of the B&I exposure isn't actually all that cyclical. Areas of weakness in a recessionary environment would be 1) headcount reductions in the finance and tech sectors (within Business), and in sports and leisure (i.e. reduced per capita spending at events). They think that they're highly unlikely to see any negative impacts in education, healthcare, and defence (which together are 50% of the business).

There's also a risk that progress on turning around the European business falls short of expectations. This could be due to competitive pressures within specific countries or a difficulty of executing M&A to reach sufficient scale. At a group level, Compass has the best metrics across the board - in terms of organic growth, margins, balance sheet health, gross business wins, retention, and ROCE. They have the largest internal procurement GPO (providing substantial cost savings) and have the widest and deepest portfolio of food service brands. I don't expect that Aramark or Sodexo will be catching up to them anytime soon.

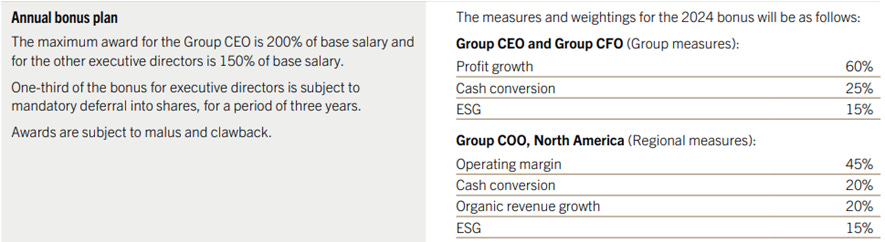

Management incentives:

Taken from the FY23 Annual Report (see page 102).

Below are the LTIP targets for 2024-26:

Nice write-up, enjoyed reading it.